gardner rich investment firm

Gardner echoed this adding that there is a possibility that the Cyprus incident would put more pressure on Malta to improve its existing system of citizenship by investment. They used a unique blend of humor and humility to showcase the research they used to discover undervalued stocks.

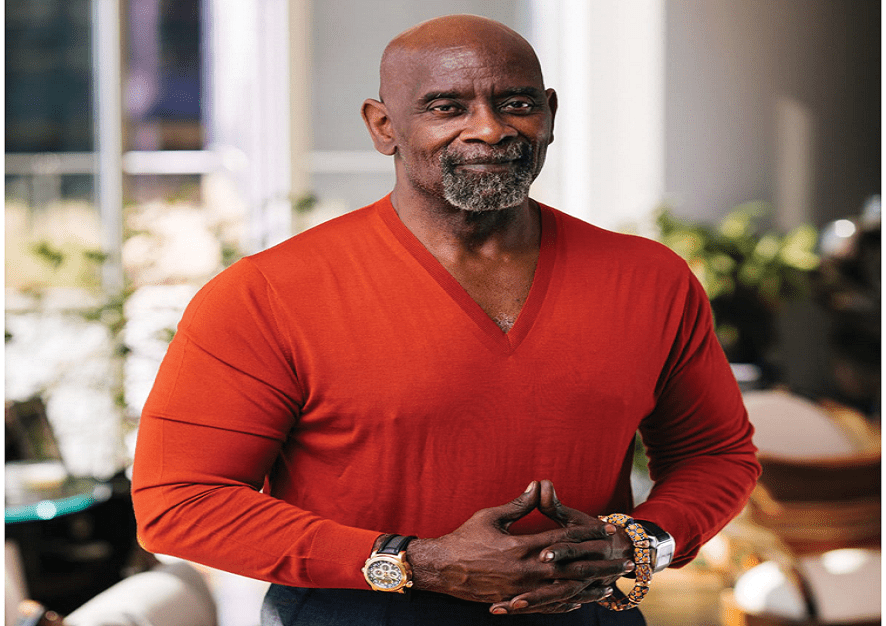

From Homeless To Millionaire 3 Success Lessons From Chris Gardner Work Motivation

Their refreshing approach to.

. Matthew has provided expert testimony before the. At Avenue we put our clients first. This stock picking service and its founders have a rich history. ZDNets technology experts deliver the best tech news and analysis on the latest issues and events in IT for business technology professionals IT managers and tech-savvy business people.

And that excludes 285 billion that Plymouth-based electric vehicle maker Rivian raised in 2019 from Ford Amazon Cox Automotive T. Founded in 1993 in Alexandria VA by brothers David and Tom Gardner The Motley Fool is a multimedia financial-services company dedicated to building the worlds greatest investment community. Our mission is to help you compound your wealth by generating consistent returns over time with as little risk as possible across all market environments. David specializes in emerging industries and higher-risk growth stocks.

Rowe Price and Blackrock. If we could have every year that the SP would go up by about a third in value we would all be a lot richer than we even ever. But I dont think it should necessarily bring the whole of migration industry into disrepute CIP St Lucias Alfred cemented. This professional service firm management program provides the frameworks you need to develop and retain talent deliver outstanding client service and build a flexible corporate culture that can exploit disruptive innovation and market trends.

The elder brother David Gardner has a keen eye for growth and he has predicted the rise of many of todays top stocks over the past two decades. We focus on helping clients achieve financial stability over the long-term. Gardner did well in both San Francisco and New York where he pioneered his own road. Much of our information is derived directly from data published by companies or submitted to governmental agencies which we believe are reliable.

HIVE Blockchain is a cryptocurrency mining firm. Matthew received his BA from UC Berkeley and JD from UCLA where he serves on the Deans Board of Advisors. We are an independent private wealth manager trusted fiduciary and partner-owned firm. Gardner then started his own brokerage firm Gardner Rich Company in Chicago to practice conscious capitalism and philanthropy.

He concentrated on wealthy and famous African-American clients. It has a minimum investment amount of 25000 and an expense ratio of 1. Paul Gardner Allen January 21 1953 October 15 2018 was an American business magnate computer programmer researcher investor and philanthropistHe was best known for co-founding Microsoft Corporation with childhood friend Bill Gates in 1975 which helped spark the microcomputer revolution of the 1970s and 1980s. It is bad luck as James said for Cyprus its a shame that its happened.

We encourage our investors to invest carefully. The Motley Fool was founded in 1993 by Tom and David Gardner. Payne Hicks Beach LLP advises high-net-worth clients from the UK and internationally many of its clients feature in the Sunday Times Rich List Forbes 400 and the Arabian Business Rich List. Theyre Tom and David Gardner co-founders of The Motley Fool the premier online resource for US-based retail investors.

Yearly rankings of the best employers in the United States Canada as well as for women diversity recent grads and beyond. Gardner Leader has also been a member of. It has an interesting mix of domestic and international work with continued instructions from Scandinavia and the Middle East in particular. All investments including stocks funds ETFs or cryptocurrencies are speculative and involve substantial risk of loss.

Prior to co-founding Kharon and its parent company The Camstoll Group Matthew headed the Middle East office for ICE Canyon a global investment firm specialized in emerging market and global credit strategies. Finally able to rent a home for himself and his son his career then rapidly ascended into the stratosphere and in 1987 he opened his own. A proposal in the Build Back Better Act before the House of Representatives would close a loophole allowing wealthy business owners to avoid paying taxes to fund healthcare. Want to invest like David and Tom Gardner.

As entry barriers rapidly disappear competition is accelerating and reshaping the business landscape for professional. As Gardner earns more money he is able to find a stable home and jumps ship to Bear Stearns a brokerage firm where he is encouraged to pursue his own investment interests. He became a stockbroker and eventually founded his own brokerage firm Gardner Rich Co in 1987. Gardner Leader provides a range of services for businesses and services for individuals including commercial corporate dispute resolution residential property and conveyancing inheritance protection and family law.

The proposal would ensure that high-income owners of certain pass-through businesses pay either the 38 percent net investment income tax NIIT or the 38 percent Medicare employment tax on. The Gardner brothers shared their investment ideas on message boards and online publications. Both in San Francisco and later in New York Gardner excels and pioneers his own road in stockbroking eventually concentrating on wealthy and famous African-American clients. Other key focus areas include advising some of.

It was the hope that that momentum would continue into 2020 and it did until the quarantine. During Derek Rodgers tenure as managing partner the firm has doubled in size since 2012. Rich has been a Fool since 1998 and writing for the site since 2004. Microsoft became the worlds largest.

Through green energy facilities it mines. After 20 years of patrolling the mean streets of suburbia he hung. VC investment in the state nearly tripled from 179 million in 2017 to 514 million in 2019 according to the MVCA. In 2006 Gardner sold his minority stake in the firm and published a memoir.

Christopher Paul Gardner born February 9 1954 is an American businessman and motivational speakerDuring the early 1980s Gardner struggled with homelessness while raising a toddler son. Macroaxis is not a registered investment advisor or brokerdealer. Newsroom Your destination for the latest Gartner news and announcements. To truly replicate their success youll need to pay for The Motley Fools premium investment newsletters like the Stock Advisor and Rule Breakers services.

David Gardner and his investment team run this service and theyve put together an excellent track record over the years. According to the 2020 North American Private Equity Investment Professional Compensation Survey by Heidrick Struggles those in the Vice President position at firms with an AUM of less than 500.

Once Homeless Millionaire Shares His Story

Homeless With A Son Chris Gardner Slept In A Public Bathroom Before Becoming A Multi Millionaire Face2face Africa

Chris Gardner Net Worth 2022 Age Height Weight Wife Kids Biography Wiki The Wealth Record

Chris Gardner From A Life On The Streets To Life In The C Suite Investors Biography

Komentar

Posting Komentar